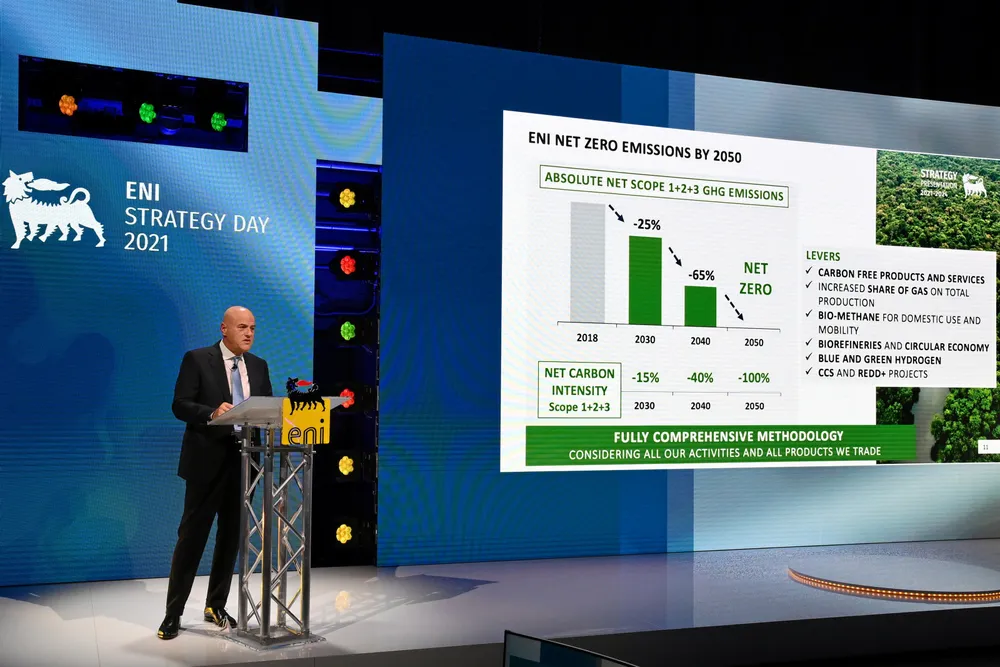

Eni aims for full decarbonisation by 2050 despite short-term growth in oil and gas volumes

Italian major aims to fully decarbonise all products and processes by 2050, while plans are in hand to boost hydrocarbon output to 2 million barrels of oil equivalent per day by 2024