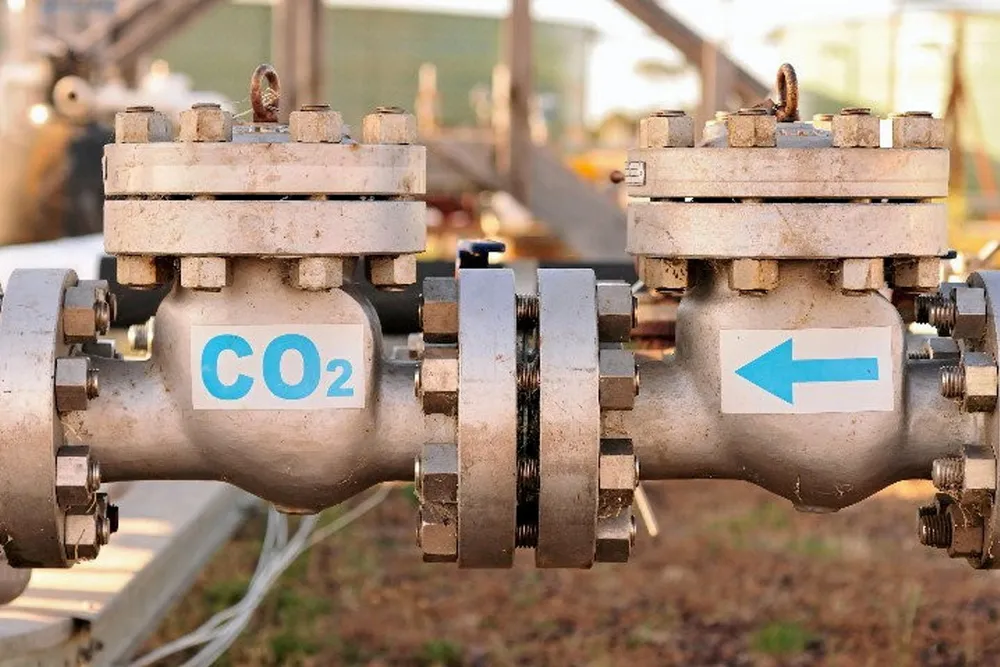

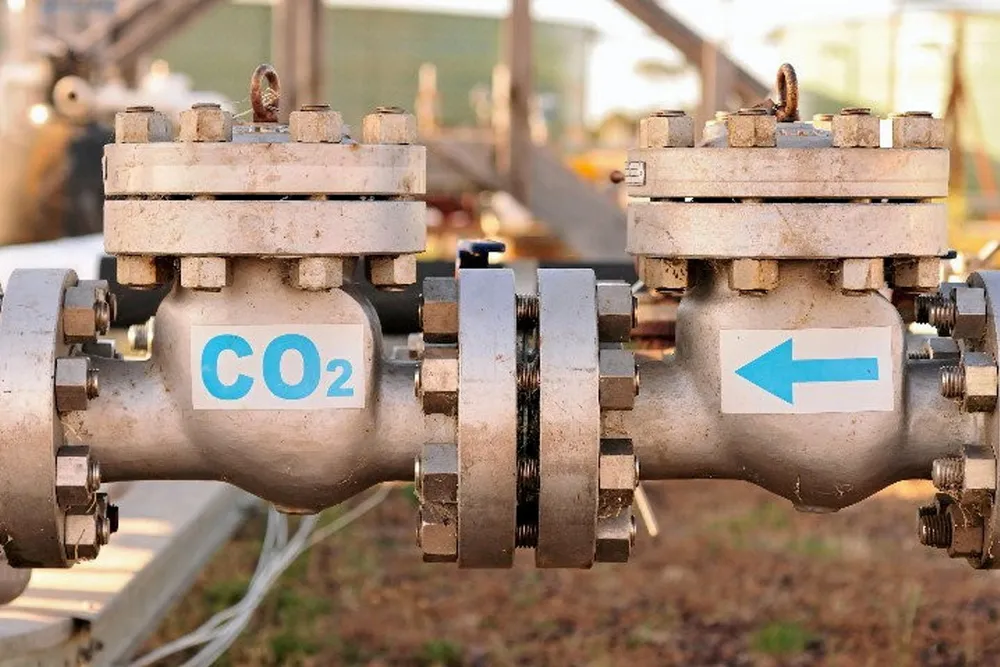

ExxonMobil sees enhanced oil recovery expertise as learning path for climate action

US supermajor is leading a raft of companies pledging to use enhanced oil recovery experience for storage projects

US supermajor is leading a raft of companies pledging to use enhanced oil recovery experience for storage projects