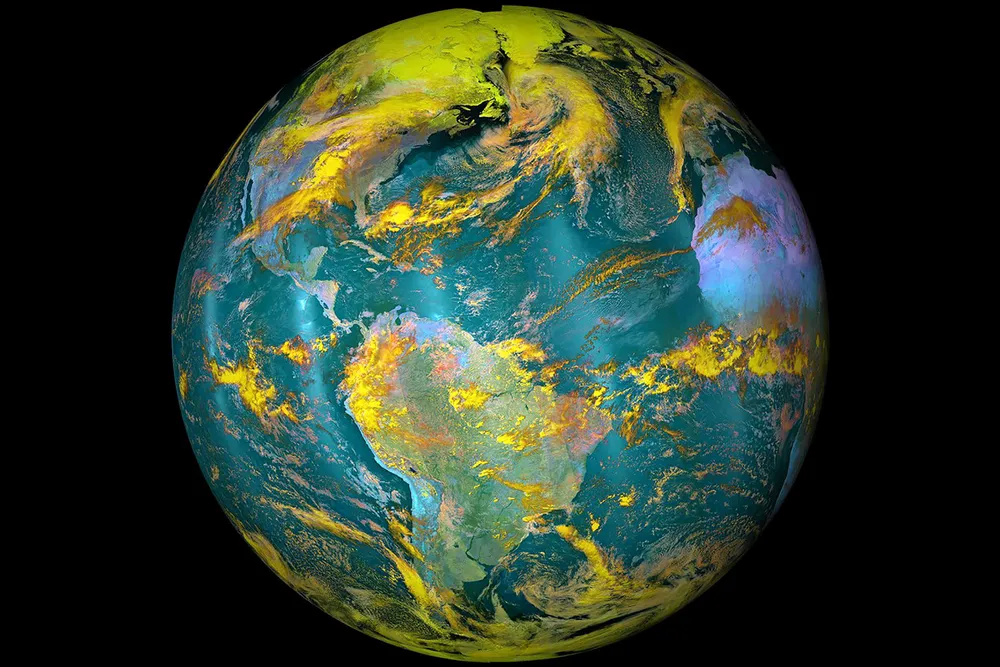

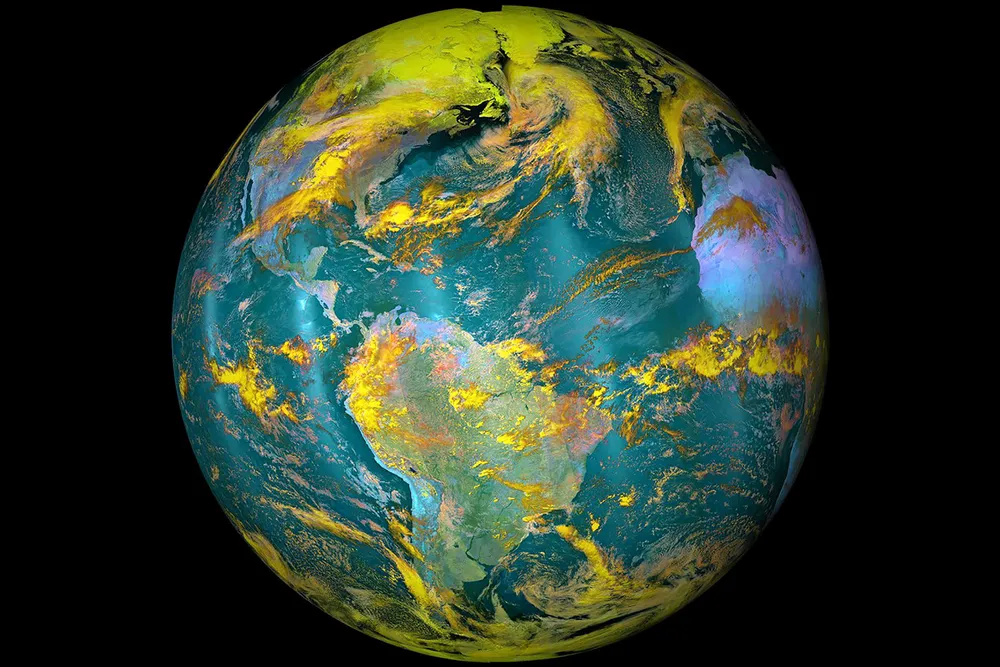

Stars need to align for CCS to meet expectations

The technology is seen as vital in limiting global temperature rises but barriers still remain to the rapid rollout needed to hit climate goals

The technology is seen as vital in limiting global temperature rises but barriers still remain to the rapid rollout needed to hit climate goals