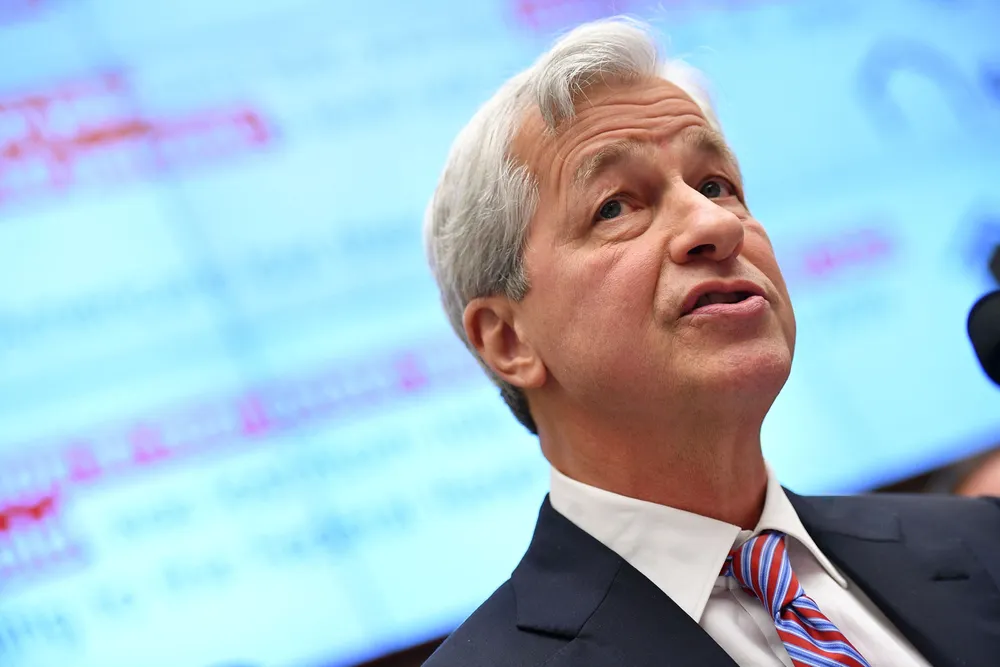

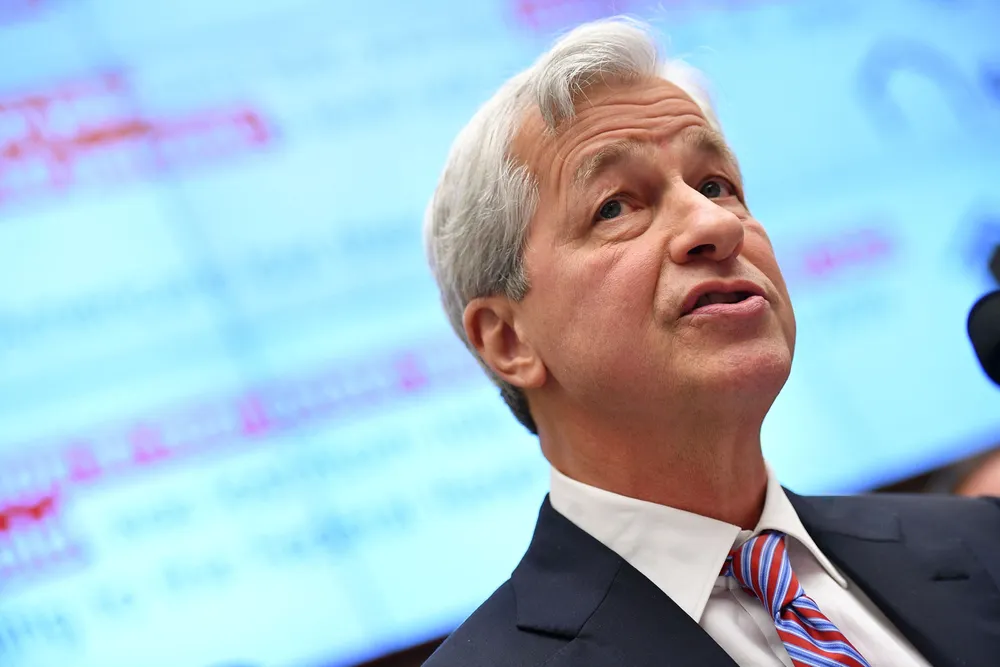

World's leading fossil-fuel financier, JP Morgan, vows to increase renewables funding

US bank pledges to reduce carbon intensity of its power portfolio by 69% by 2030, but its oil and gas emission-reduction targets are far less ambitious

US bank pledges to reduce carbon intensity of its power portfolio by 69% by 2030, but its oil and gas emission-reduction targets are far less ambitious