'More global vision, please': Petrobras boss fires from the hip on bureaucracy and calls for reform

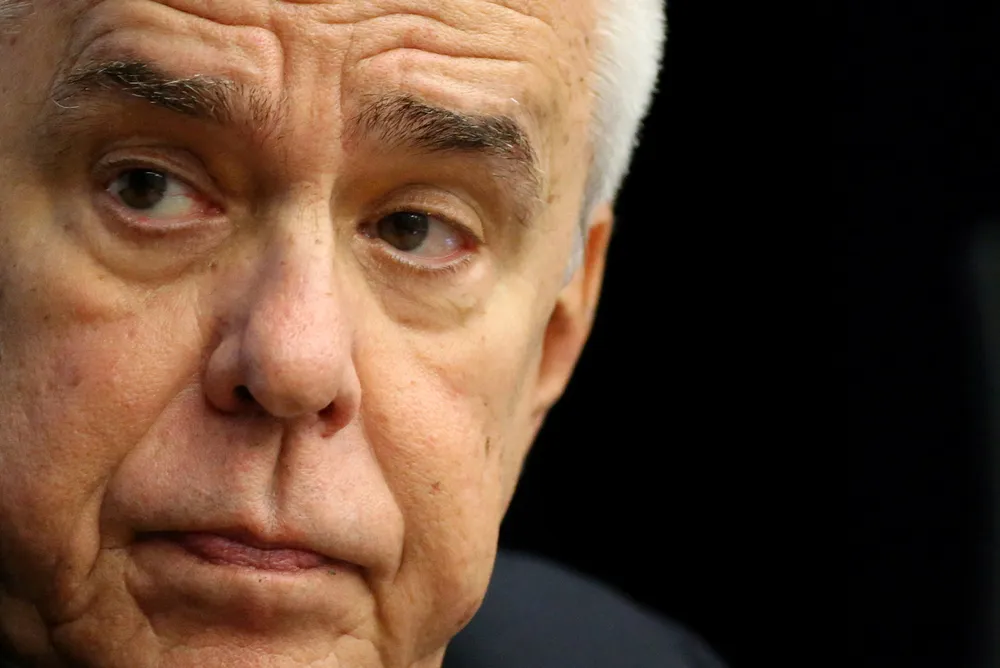

Roberto Castello Branco was in no mood for mincing his words when he considered the efficiency of Brazil's regulatory system, threatening to take some of his company's investment budget to Guyana