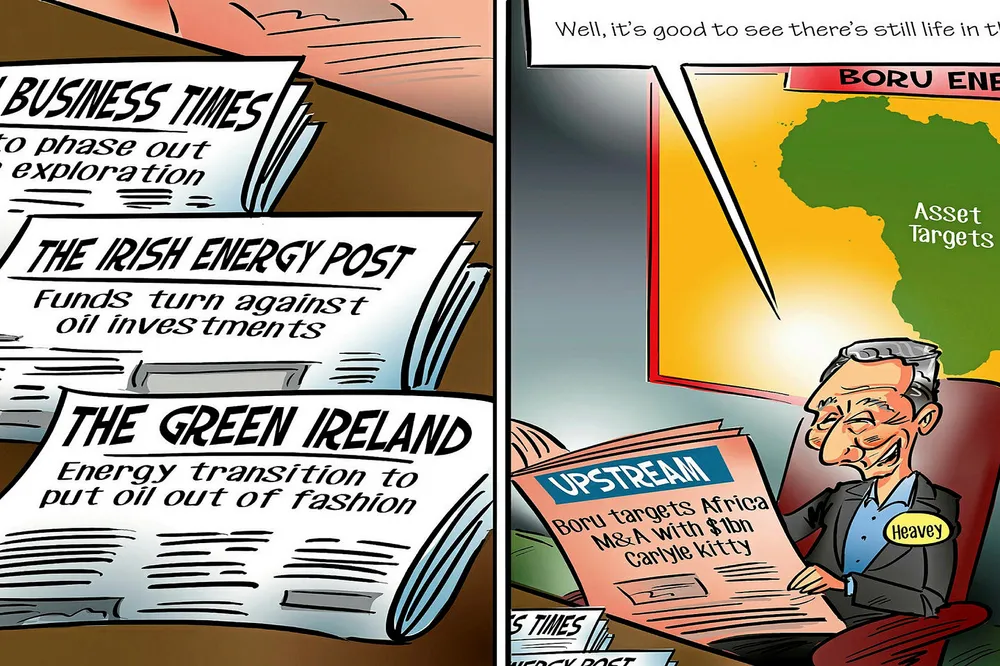

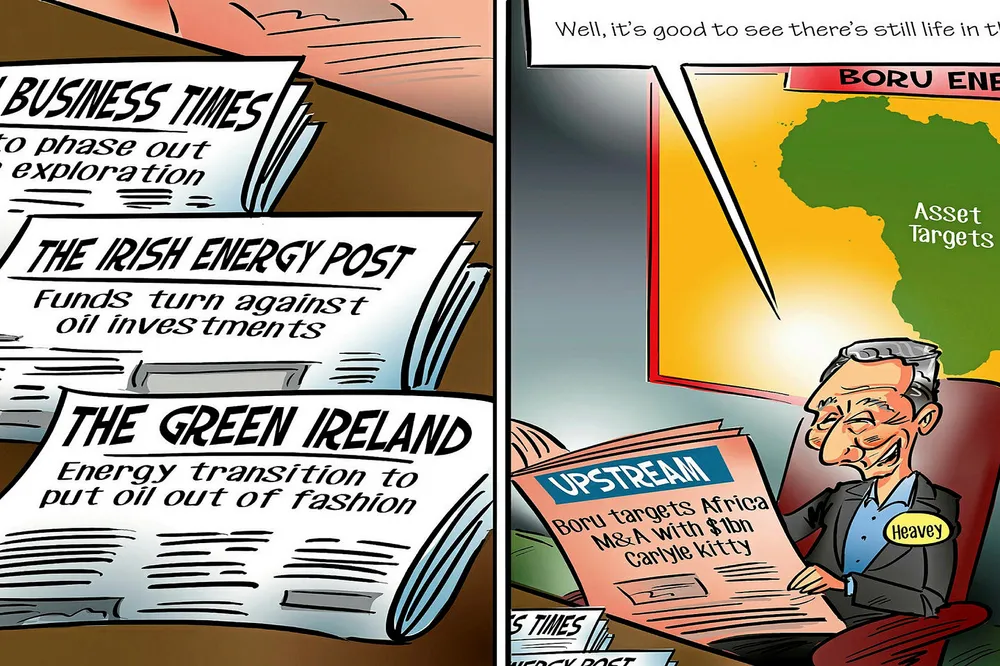

Africa holds M&A riches as majors re-jig portfolios

Opportunities abound for independents and others to snap up assets as larger players get into bigger plays

Opportunities abound for independents and others to snap up assets as larger players get into bigger plays