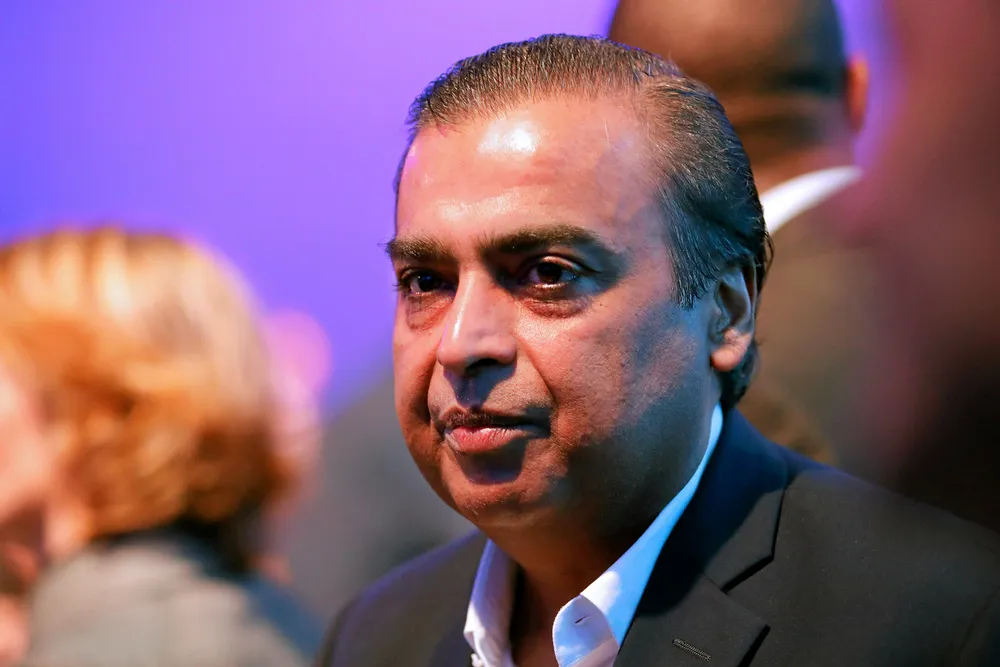

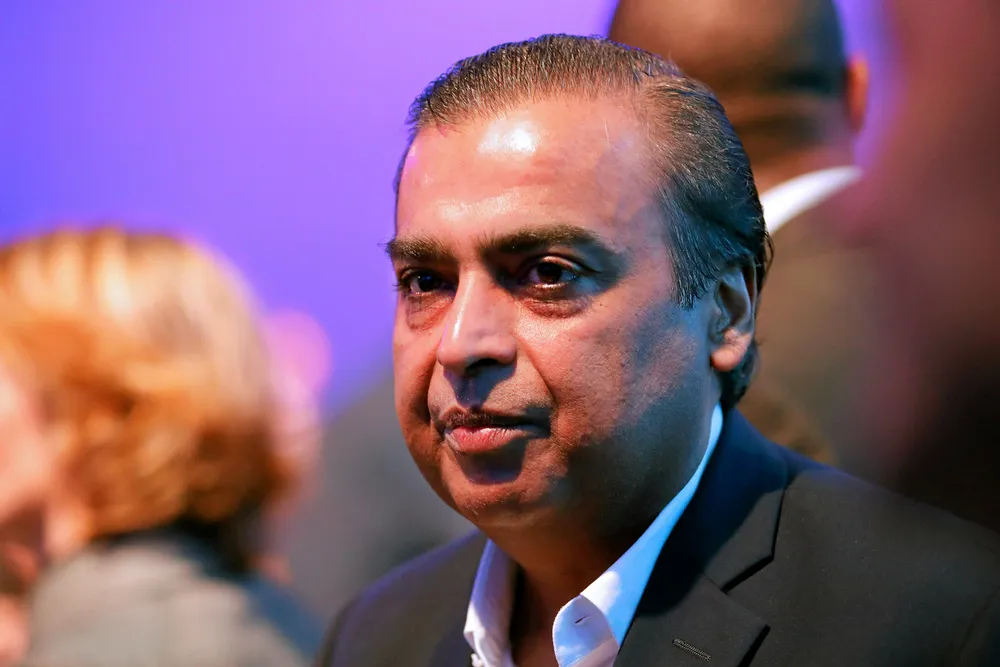

Reliance-Aramco put $15bn oil-to-chemicals deal on the backburner

The two players had signed a non-binding LoI in 2019, with Reliance potentially selling a 20% stake in its oil-to-chemicals business to Aramco

The two players had signed a non-binding LoI in 2019, with Reliance potentially selling a 20% stake in its oil-to-chemicals business to Aramco