Russia's Novatek ups investments despite market turmoil

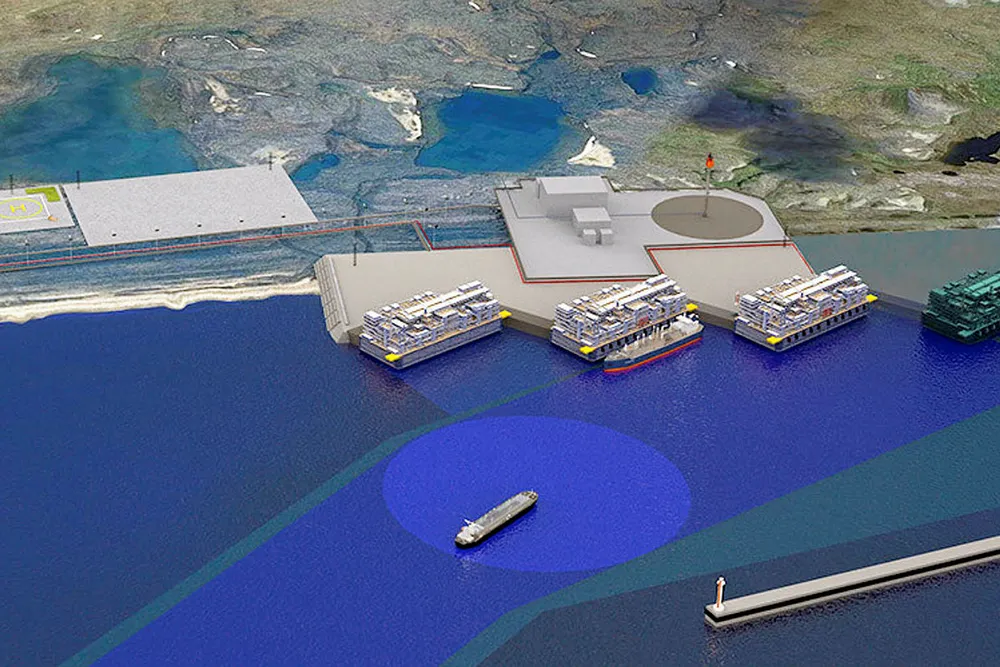

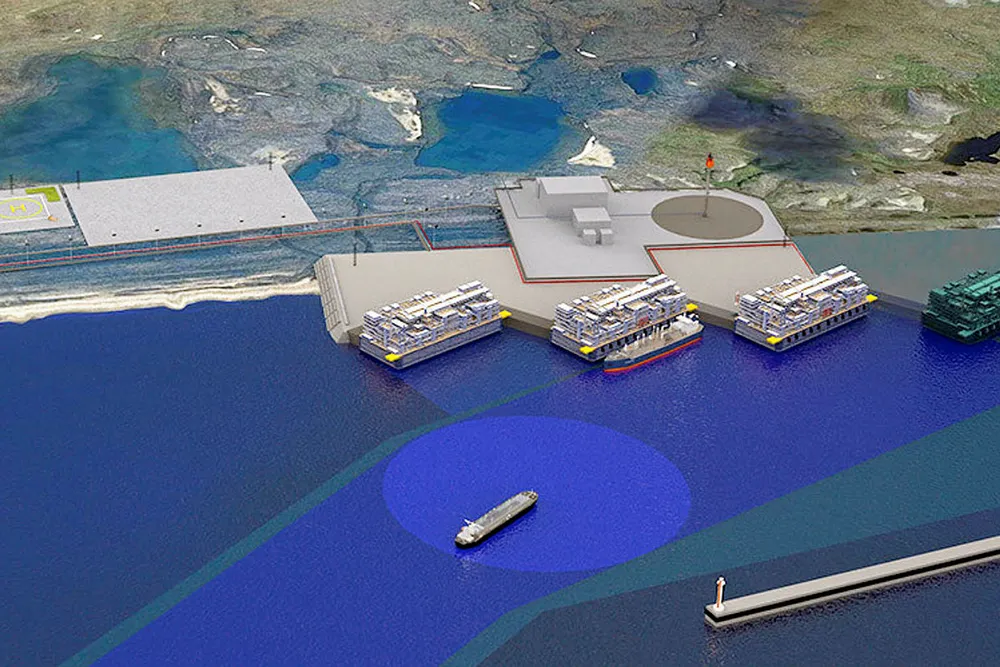

Russian independent gas producer moves ahead with Arctic LNG 2 and other greenfields in the country as it outperforms other gas players, including Gazprom

Russian independent gas producer moves ahead with Arctic LNG 2 and other greenfields in the country as it outperforms other gas players, including Gazprom