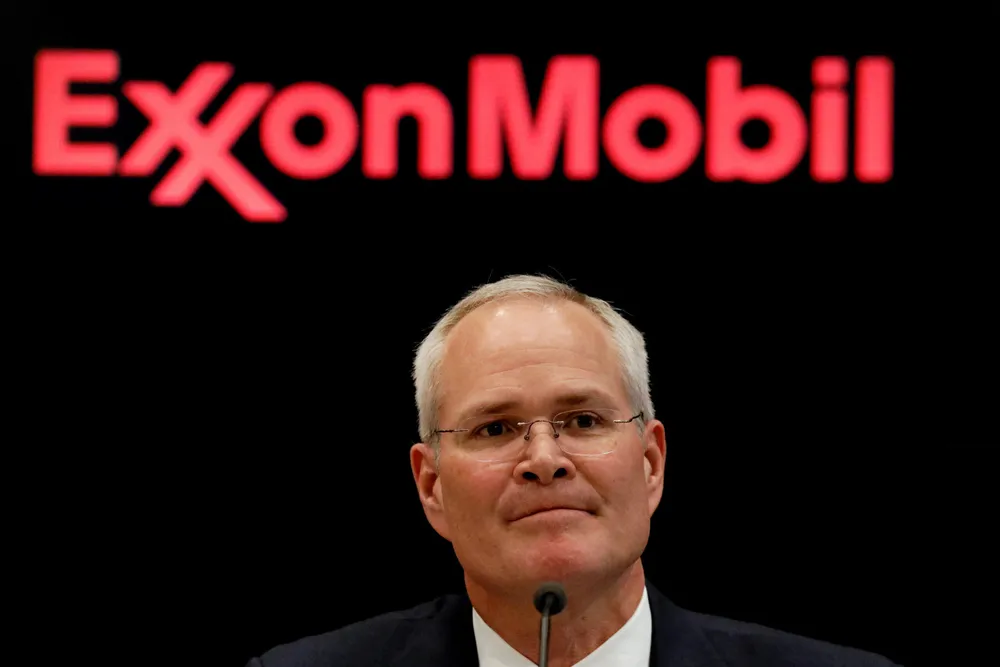

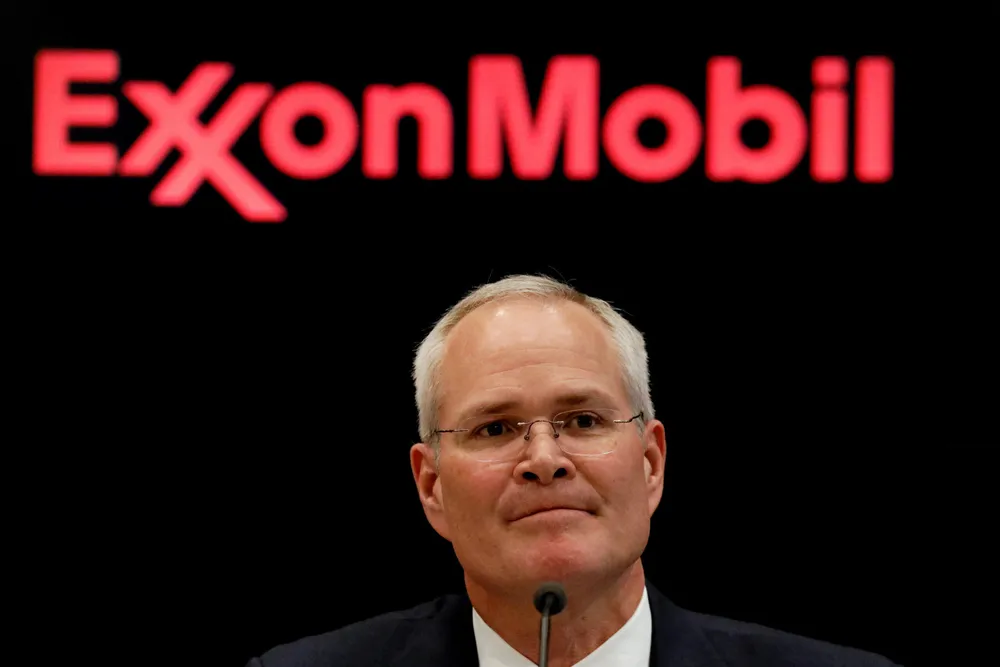

Setback for ExxonMobil as two board seats go to activist investor group members

Oil and gas giant takes hit for perceived lack of effort on environmental issues, underperformance

Oil and gas giant takes hit for perceived lack of effort on environmental issues, underperformance