Pemex looks to shed more of Trion

Pemex is now set to offload a larger stake in its Trion discovery than it had originally planned after the Mexican state player proposed amendments to the farm-out.

Mexican regulators have signed off on changes on the joint operating agreement for a farm-out process on the deep-water block, which among other things reduced Pemex's proposed share in the block from 45% to 40%.

The modifications approved at a meeting of Mexico's National Hydrocarbons Commission were floated by Pemex after reviewing more than 150 comments in discussion with industry.

Namely, the new version includes a number of measures that loosen the control of non-operator Pemex over the JOA.

For instance, one jettisoned provision would have allowed the non-operating partner to remove the new operator after three years.

Removals would only be allowed under "grave" circumstances, and only after Mexico's CNH had served a notice of non-compliance and offered an opportunity to remedy the situation.

Arbitration in the event of a dispute would also be moved outside of Mexico to a "neutral" centre proposed as Calgary, Canada.

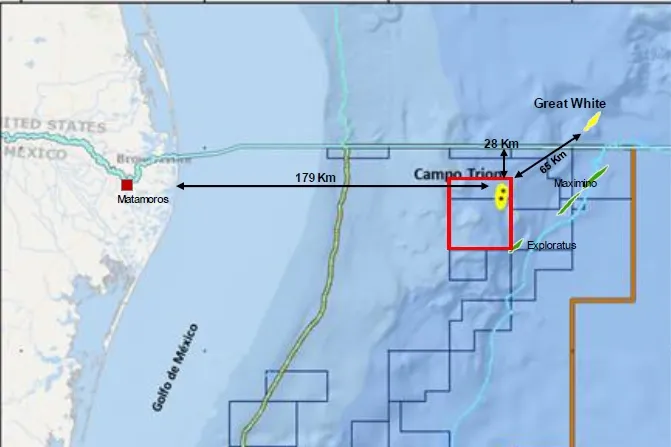

The 2012 Trion discovery, estimated to contain about 485 million barrels of possible reserves, is expected to require some $11 billion in investments over its lifetime.

Pemex, which has little experience in developing deep-water fields, has been frank about its desire to bring in experienced, high-profile partners to help, given its limited budget to tackle the enormous task.

Under Mexican law, partners must be selected by an open public bid process rather than direct negotiations.

Ten companies have requested pre-qualification for the process.

They are: Australia's BHP Billiton, UK supermajor BP, US supermajors Chevron and ExxonMobil, Japan's Inpex and Mitsubishi, European supermajors Shell and Total, Russia's Lukoil and Malaysia's Petronas, according to government data.

Mexico is gearing up for its first ever tenders this December on deep-water acreage, the final and most highly anticipated phase of its first multiphase bid round to open the industry to private participation following reforms to end the nearly 80-year monopoly of state oil company Pemex.

Apart from Trion, there is a process for open bidding on 10 deep-water blocks in the northern Perdido fold belt and southern Salina del Istmo basin.

(Copyright)