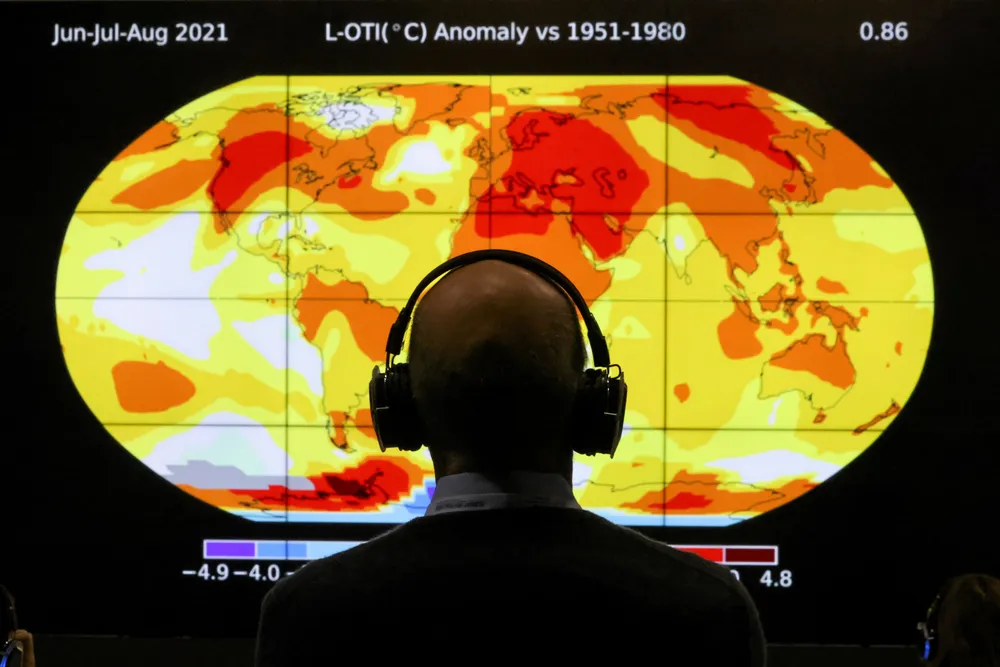

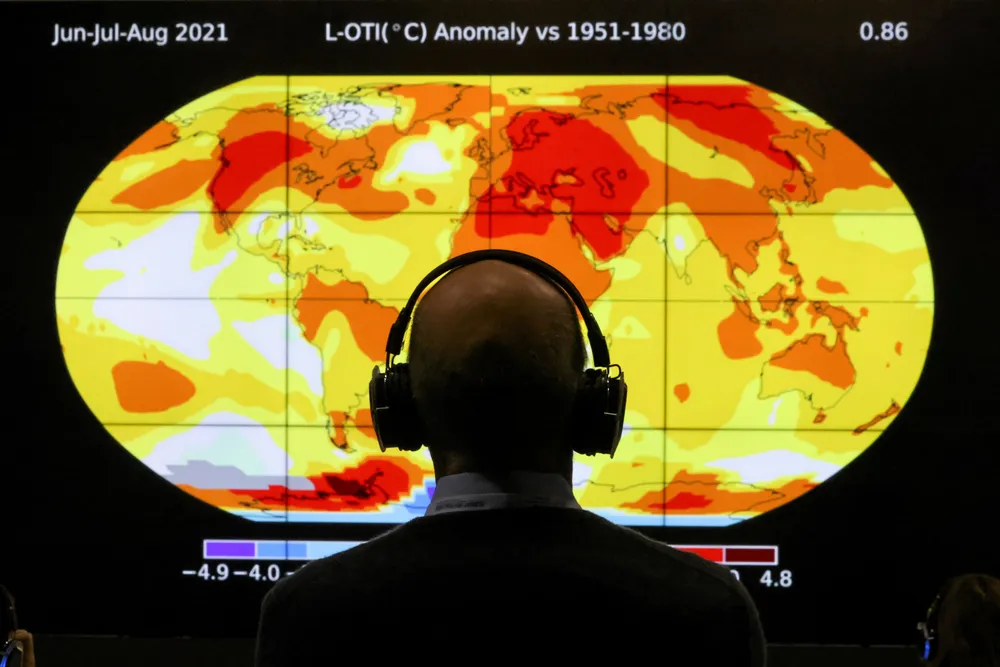

2021 shows there is no turning back on decarbonisation

A sense that the world has reached a point of no return for energy transition means humanity needs to prepare for volatility and knuckle down to the task at hand

A sense that the world has reached a point of no return for energy transition means humanity needs to prepare for volatility and knuckle down to the task at hand