Learning the hard way: Energy giants leap forward with transition, but could have been swifter

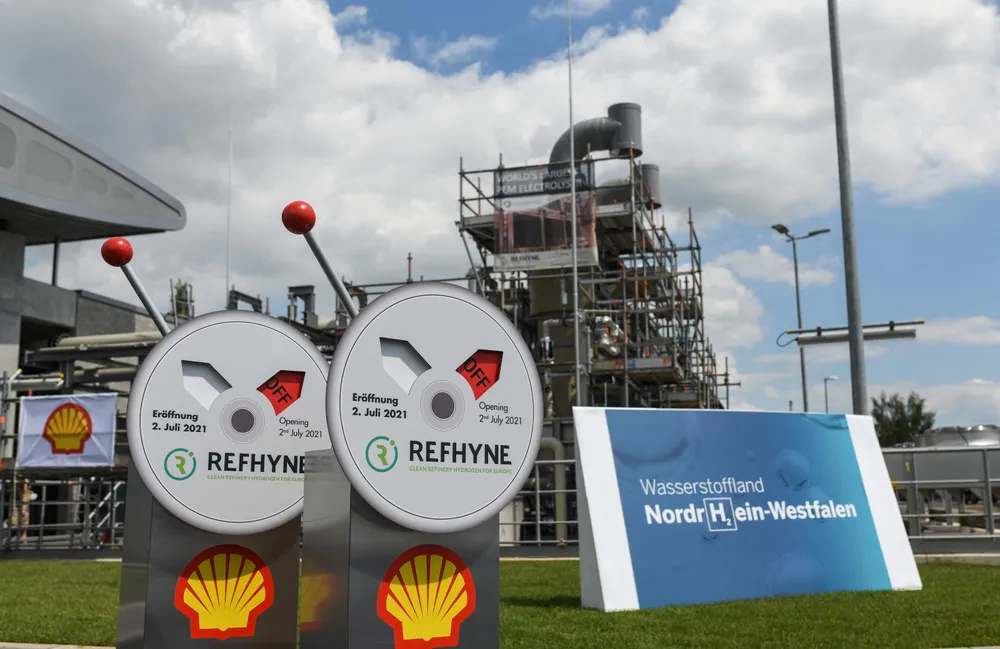

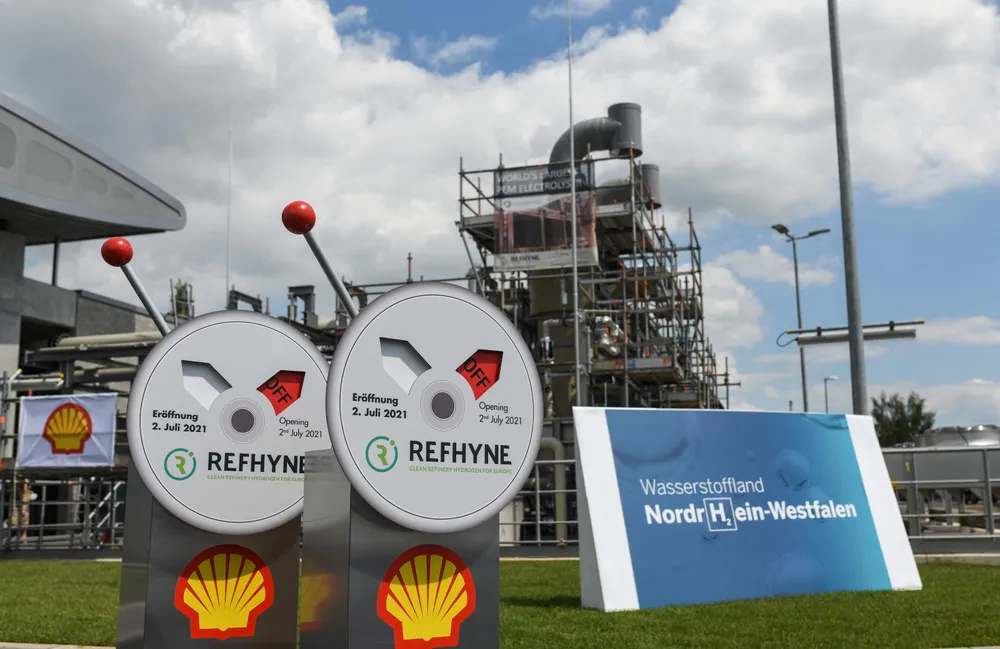

BP and Shell backed away from early green energy efforts years ago, but are now pressing ahead with hydrogen, renewables and carbon capture plans

BP and Shell backed away from early green energy efforts years ago, but are now pressing ahead with hydrogen, renewables and carbon capture plans