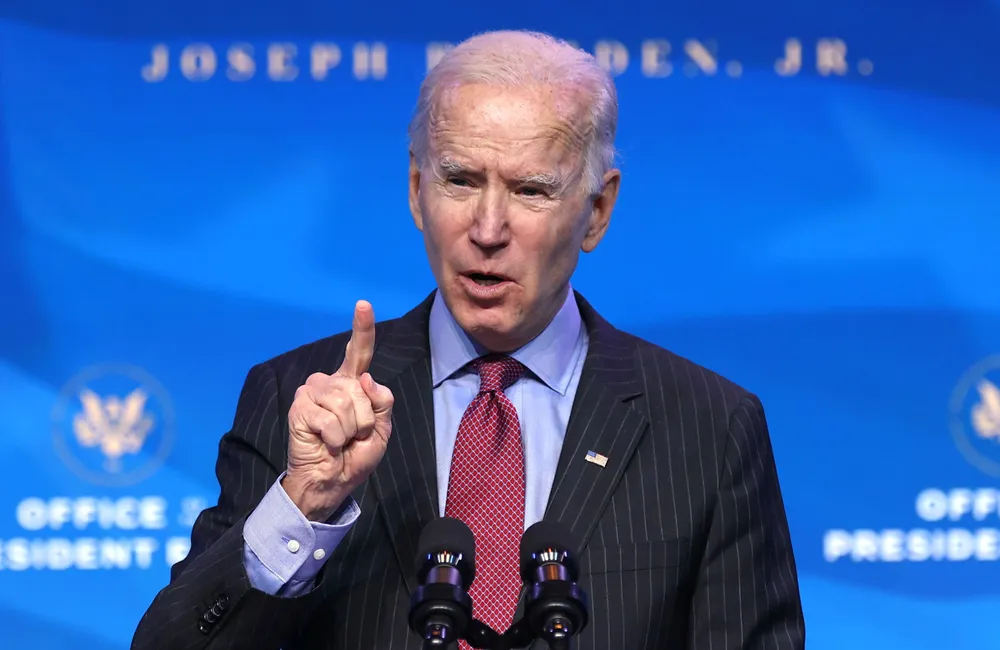

OPINION: Biden's energy 'revolution' about to meet political reality

Industry may welcome stable leadership — and slim Democratic margins in Congress that could limit anti-fossil fuel agenda

Industry may welcome stable leadership — and slim Democratic margins in Congress that could limit anti-fossil fuel agenda