OPINION: Big oil feels the heat in landmark week

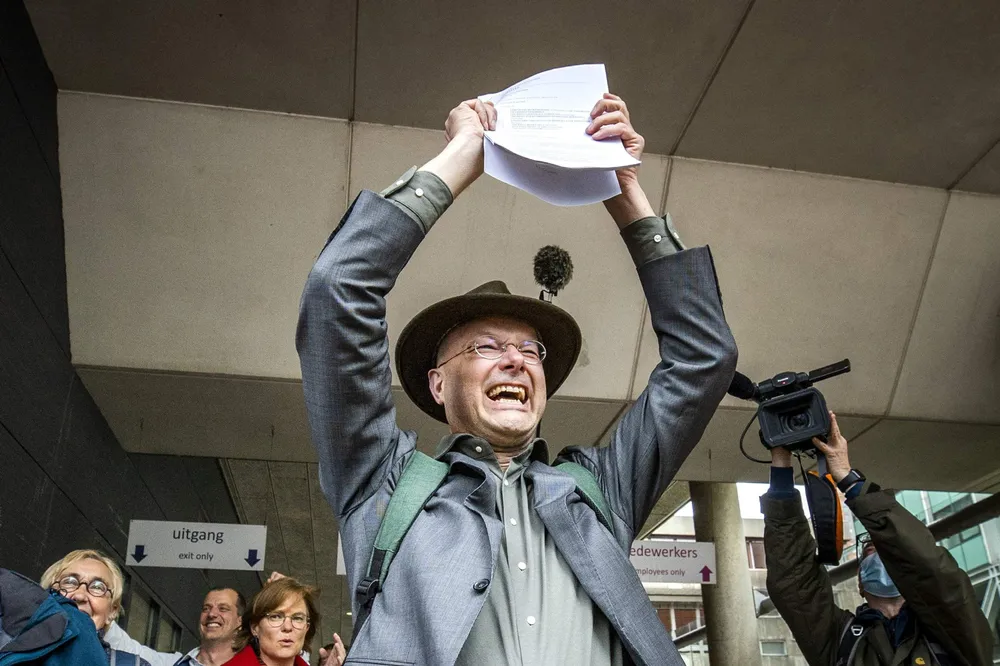

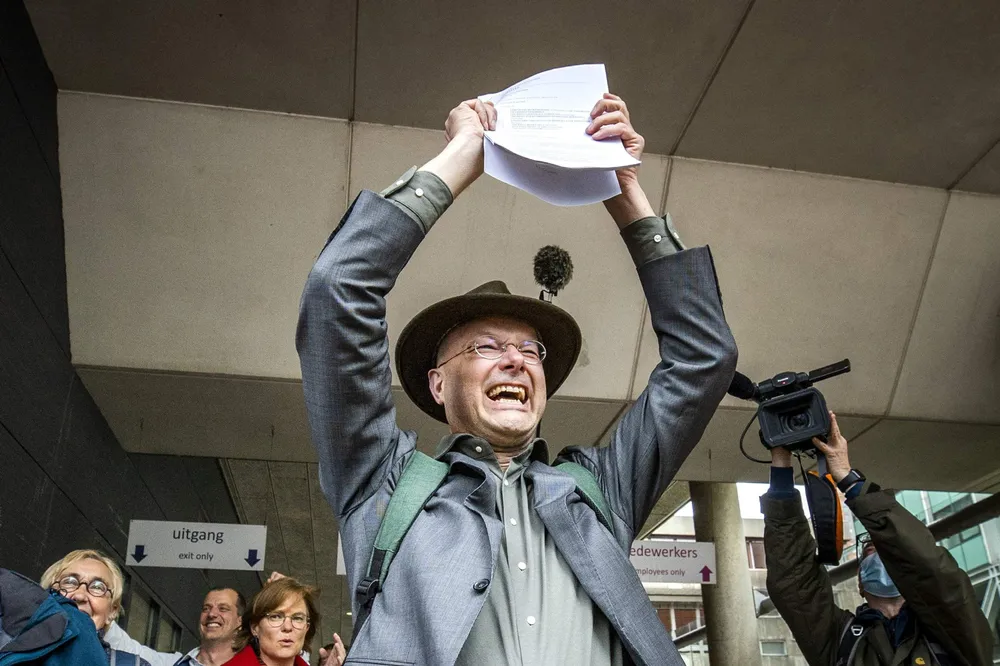

Court loss for Shell and US supermajors' shareholder battles increase pressure on industry over emissions reduction

Court loss for Shell and US supermajors' shareholder battles increase pressure on industry over emissions reduction