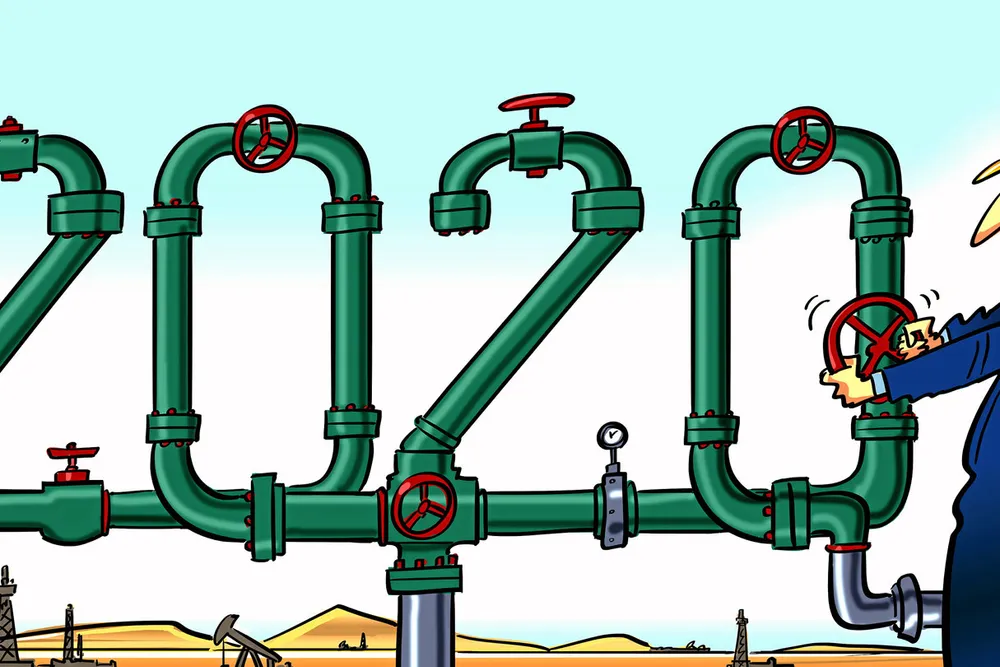

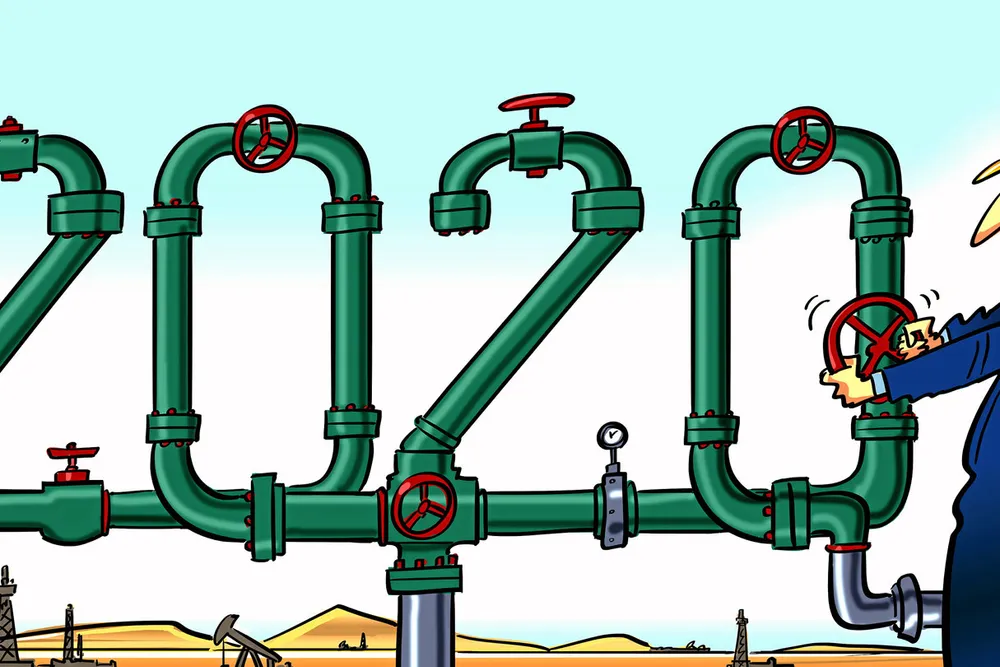

Sidetracked: a year in Upstream cartoons

Upstream looks back on a tumultuous year for the oil and gas industry in this selection of cartoons from Sidetrack, our weekly feature. Illustrations by Rytis Daukantas

Upstream looks back on a tumultuous year for the oil and gas industry in this selection of cartoons from Sidetrack, our weekly feature. Illustrations by Rytis Daukantas