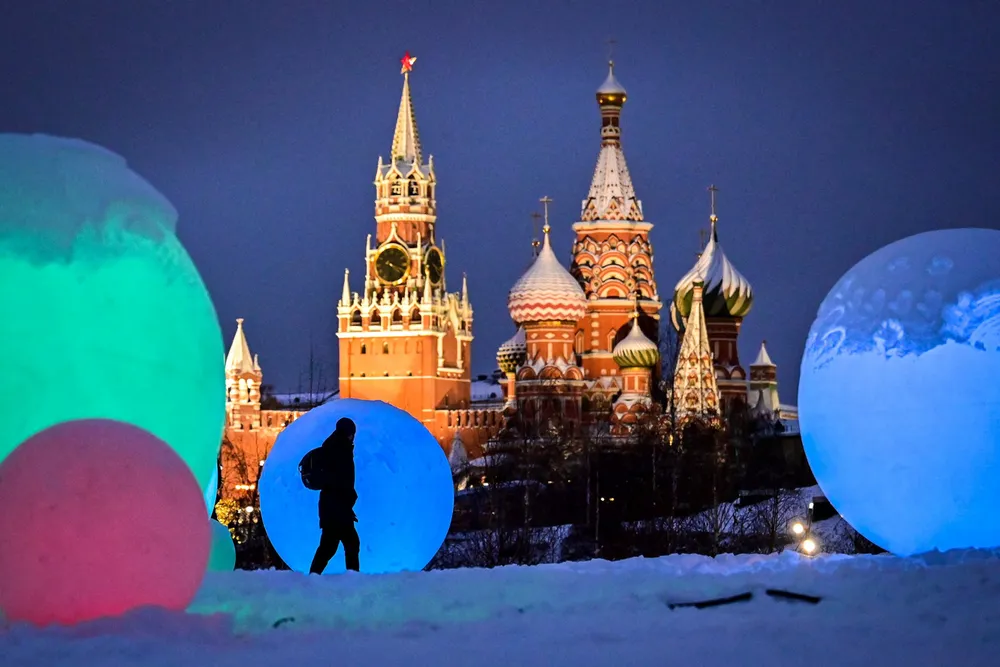

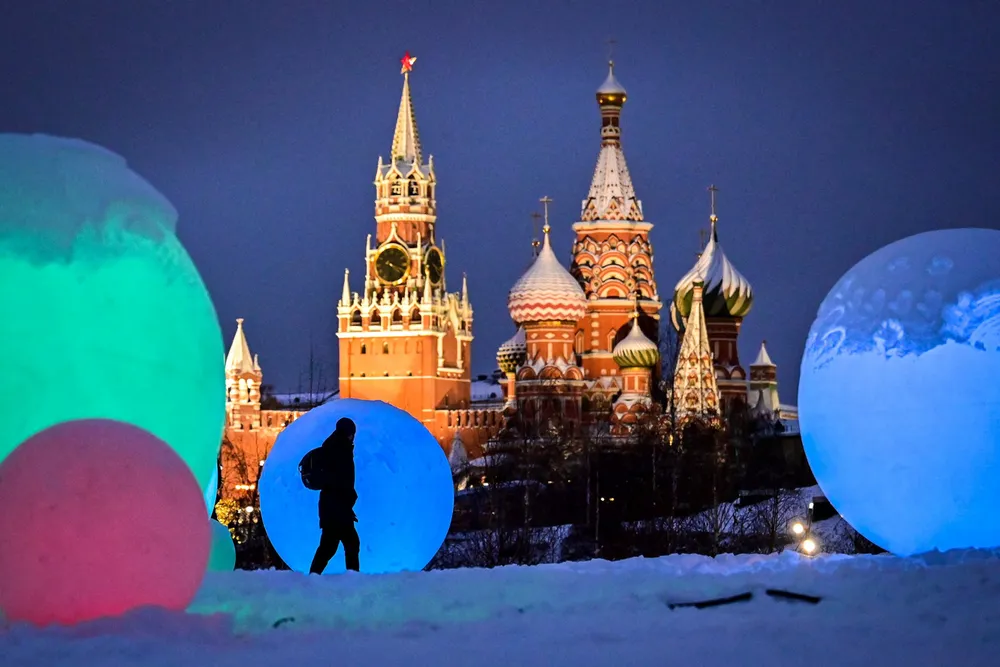

Gazprom hits out against accusations as European impasse deepens

Russian gas monopoly lashes out against Europe Union as its own gas supplies to the continent decline in the face of strong demand

Russian gas monopoly lashes out against Europe Union as its own gas supplies to the continent decline in the face of strong demand